CHOOSING THE RIGHT COPY TRADING PLATFORM

This article will show you how to go about the whole copy-trading idea. We will examine choosing the right copy trading platform to begin your trading career.

UNLOCKING THE POWER OF COPY TRADING: A BEGINNER’S GUIDE

What is copy trading? Copy trading is a social type that allows individuals in the financial markets to duplicate positions established and maintained by others automatically. Unlike mirror trading, which allows traders to replicate certain strategies, copy trading transfers a portion of the copying trader's cash to the copied trader’s account.

COPY TRADING PROS AND CONS: IS IT RIGHT FOR YOU?

Here are some of the benefits of copy trading on platforms such as the Dominion Markets

- Accessibility. Copy trading involves no prior trading knowledge, making it ideal for inexperienced traders.

- Access to another trader's knowledge. You can gain from the wisdom and knowledge of someone with more market experience than you by copy trading.

- Taking advice from more experienced traders. You may learn about markets and broaden your expertise by watching more professional traders.

- Portfolio diversification. You can acquire access to different markets and trading styles by duplicating trading signals provided by diverse traders. It allows you to enter markets with little or no expertise, making copy trading valuable even if you are a seasoned trader.

Here are some of the disadvantages of copy trading.

- Less control: When you copy trade, you give someone else control of your trading. This reduction in control means that you cannot make your own decisions about which trades to enter and exit.

- Copy trading can be a great method to learn about different trading tactics, but can also limit your learning potential. You must be actively involved in trading to comprehend the rationale behind the copied trades.

- Copy trading does not protect you against market risk. Even if the trader you are mimicking is profitable, you could still lose money.

DEMYSTIFYING COPY TRADING: HOW IT WORKS

Once accounts are linked, any trading action taken by the copied trader in the future, such as opening a position, placing stop loss and take profit orders, or closing a position, is also executed in the copying trader's account. Moreover, it is in proportion to the copied trader's account and the copying trader's allotted copy trading funds.

The copying trader usually retains the capacity to disconnect and handle copied trades. They can terminate the copy connection entirely, closing all copied trades at the current market price.

Copied traders, known as leaders or signal providers, are frequently compensated by flat monthly subscription fees paid by a trader, a signal follower, wanting to replicate their transactions.

Aside from that, well-known investors can receive a 100% spread rebate on their transactions. The incentive programs encourage traders to allow others to monitor and imitate their strategies rather than trading discreetly.

DISCOVER THE TOP COPY TRADING PLATFORMS OF 2023

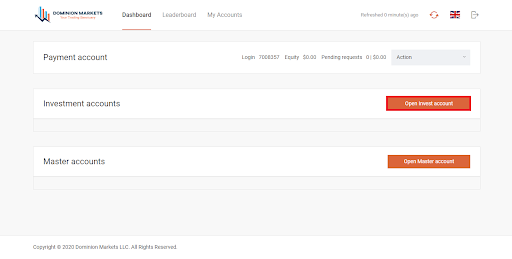

Dominion Markets is among the best copy trading platforms out there. To access the copy trading feature, you should register for a Dominion Markets account. To begin, log in to your Dominion Markets account and navigate to your Dashboard. Your navigation bar is on the left side. Locate and select PAMM.

Dominion Markets PAMM

This will take you to the PAMM dashboard, where you can see your Investment and Master accounts.

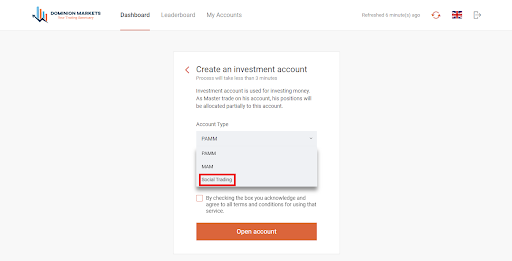

To open an account, make sure you're still on the PAMM dashboard and click the Open Investment Account button. The website will send you to a new page titled Create an Investment Account.

Dominion Markets Investment Account

It is critical that you select Social Trading in the Account Type box. If you do not select this option, the investment account you wish to open will be unable to follow accounts on the Leaderboard.

Dominion Markets Social Trading

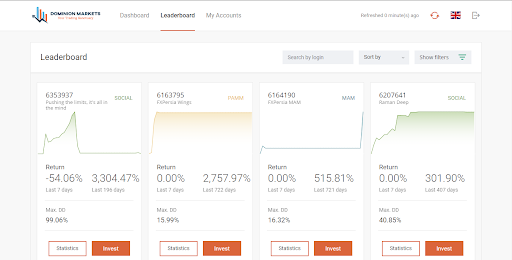

After you've created your Investment Account, navigate to the PAMM Dashboard Navigation Bar and select the Leaderboard option. All of the accounts that have been performing well are listed here. As an investor, you can view the account's return for the last 7 days as well as the account's lifetime.

If you've located an account you'd like to follow, click the Statistics tab to see the trader's equity curve and performance fee, among other things. If you agree with the pricing structure, click the Subscribe to Account icon in the top right corner of the page.

Dominion Markets Leader board

COPY TRADING VS SOCIAL TRADING: WHICH IS BETTER?

Social trading is an online trading that allows traders to connect and share information, strategies, and insights on investment decisions. The main aim of social trading is to help traders improve their trading performance and make more profitable trades by connecting with other traders and sharing information. Copy trading is part of the broader aspect of social trading.

Copy trading is good if you are new to online trading and want to start making a profit without fully understanding the aspects of trading. Conversely, social trading is better if you are a bit more seasoned. Social trading will enable you to sharpen your trading skills and share with others your trading experience.

Traders can benefit from both trading styles. Start with copy trading if you are a beginner. For the more seasoned traders, you can participate in social trading to sharpen your skills.

PICKING THE PERFECT COPY TRADING PLATFORM FOR YOU

There are a few crucial elements to consider while selecting a copy trading platform:

- Regulation: Select a platform that is under regulation by a credible financial authority. Regulation helps protect your cash while ensuring the platform operates fairly and transparently.

- Consider the features crucial to you, such as replicating multiple traders, setting your risk limits, and monitoring your assets.

- Fees: For their services, several copy trading platforms demand a fee. Before you choose a platform, make sure to compare the prices it charges.

- Read reviews from other traders to find out what they think of the various copy trading sites. Reading reviews might help you avoid selecting an untrustworthy platform or one with a reputation for poor customer support.

MASTERING RISK MANAGEMENT IN COPY TRADING

Despite copying from seasoned traders, you should still place risk management measures. Here are some of the measures you can take:

- Diversify your portfolio. You should spread your risk. You can achieve this by copying multiple traders that use different strategies. Diversifying your portfolio ensures that if one trader has a bad run, you can still profit from the others you copy from.

- Use stop-loss orders. You should place stop losses on the copied trades. Stop losses automatically close trades when the price reaches your set risk limit. Stop losses and reduce your risk per trade.

- Monitor your trades regularly. Although you are copying your trades, you should monitor them regularly. Make sure they are performing as you expected them to.

BOOST YOUR FOREX PROFITS WITH COPY TRADING STRATEGIES

Here are some copy trading strategies that will boost your profits.

- Don't blindly copy every trade. A trader needs to have a good track record. You should use your judgment. Don’t just copy blindly without understanding what the traders you are copying from are doing.

- Don't risk more than you can afford to lose. Risk management is at the center of trading, even copy trading. Ensure you employ risk management that you are comfortable with.

- Be patient. Copy trading requires a lot of patience. It is still online trading and not a get-rich-quick scheme. There will be losses and gains. If you remain patient, you will thrive in the market.

DIVERSIFY YOUR PORTFOLIO: COPY TRADING STRATEGIES

You need to diversify your portfolio when copy trading to reduce your risk and get better results. Here is how:

- Choose traders with various strategies. When selecting traders to replicate, finding traders with diverse methods is critical. If one trader has a bad run, this will help to lower your overall risk. When you have many different traders, you can survive adverse market conditions since you have various strategies that thrive in different market conditions.

MONITORING YOUR WAY TO COPY TRADING SUCCESS

Monitoring your copy trading account is a crucial part of copy trading. It aids in risk management, as stated earlier. Here are ways to ensure you monitor your account successfully.

- Check your trading platform regularly. Most copy trading systems thoroughly summarize your transactions, including the trader you're copying, the asset you're trading, the position size, and the current profit/loss. You should review this information frequently to ensure that everything is in order.

- Create alerts. Many copy trading platforms allow you to set up alerts for particular events, such as when a transaction is opened or closed or when you meet a specific profit/loss target. Alerts can help you keep track of your trades even when you aren't regularly watching them.

- Compare your performance to that of the trader you are imitating. To ensure you achieve the same outcomes as the trader you are copying, compare your performance to theirs. You achieve this by keeping track of your average return and risk every trade. If you are drastically underperforming the trader you are mimicking, this could indicate a problem.

SUCCESS SECRETS: COPY TRADING TIPS FOR NEWBIES

Copy trading is highly profitable if you follow the tips I have highlighted in the article. The tips are to manage your risk, monitor your trades, diversify your portfolio, and pick a proper copy trading platform. These tips are your secret to success in copy trading.

If you are new to forex trading, join the Dominion Markets today to familiarize yourself with the financial markets before you embark on your copy trading journey.